Welcome to Platt

Rushton

Professional,

personable service where the

client comes first.

Accountancy Firm in Leigh-on-Sea.

Please feel free to get in touch for a free initial consultation

GOING THE EXTRA MILE.

Amid all the changes in the business and financial world in recent years, one thing has remained unchanged – our commitment to our clients.

At Platt Rushton, we believe the client comes first, and we strive in every respect to meet your needs and expectations.

Whether it is traditional tax and accounting services or proactive business advisory services, your personal Self Assessment return or your company’s strategic business plan, we approach the task with the precision and dedication you would expect from an established and highly trusted firm.

Meeting your needs with client-focused services

Our commitment to putting our clients first comes through in the services we

provide. At Platt Rushton we have developed the traditional range of services into innovative client-focused services that provide not only all the reliable background support you would expect from a professional firm but also forward-thinking advice on how to improve your situation.

Accounting

Routine accounts for your business or company, regular management accounts, service charge and other specialist accounting requirements.

Tax & compliance

Personal, corporate and trust tax compliance. Company secretarial services and other regulatory reporting.

Advisory & support

Cloud accounting, VAT and PAYE support services. Business and personal tax planning advice. Other specialist assignments.

Audit & Assurance

Statutory audits and specialist assurance assignments for a range of entities.

Building and developing strong partnerships.

For over 33 years, we’ve helped business owners like you access the necessary expertise to better take care of their finances. That means exploring opportunities and sharing expertise wherever we can.

“We work closely with Platt Rushton and are extremely satisfied with their professionalism and reliability. They offer prompt and effective communication, provide accurate reports, and have a deep understanding of the complexities involved in property development.”

Seven Developments

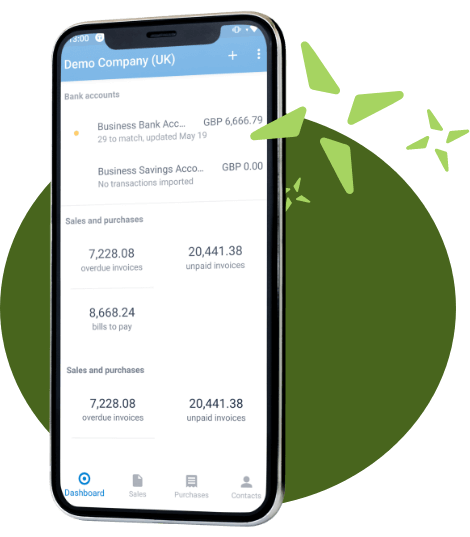

Cloud support.

Cloud-based accounting systems allow us to work closely with you and provide real-time, relevant advice.

We can get you set up on the best software to streamline your bookkeeping routine, keep you on track with up-to-date online guidance as soon as we get it, and give you advice on how to manage your VAT obligations to HMRC.

Get business support

when you need it.

Our resource base is designed to help you learn more about business, tax and finance topics. Regular blog content, dates and deadlines for your calendar, and calculators: all made to give you support whenever you need it.

Accounts Senior

Responsibilities to include: Preparation of annual accounts and tax compliance work Preparation of service charge accounts You will have: Prior experience in an accountancy practice and experience working on service charge accounts This is an office-based role but...

Accounts and Audit Senior

Responsibilities to include: Preparation of annual accounts and tax compliance work Statutory audit work You will have: Prior experience in an accountancy practice and experience in carrying out statutory audits This is an office-based role but with visits to clients...

Accounts and Audit Assistant

Responsibilities to include: Preparation of annual accounts Preparation of corporate and personal tax returns Assisting with bookkeeping, VAT returns and management accounts Assisting with audit work You will have: Good A-Levels or equivalent Good working knowlege of...